Why Summer is the Secret Season for Medicare Prep

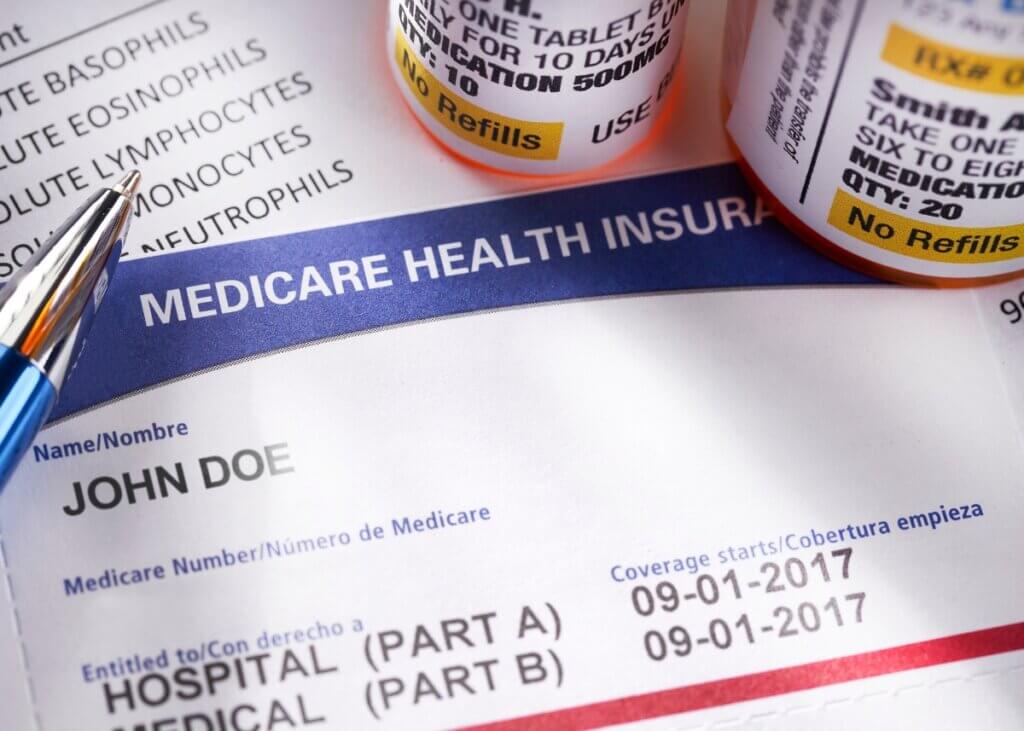

Medicare Open Enrollment may still be a few months away—but savvy planners know now is the time to get a jump start.

Why? Because fall comes fast, and the choices you make during the enrollment window can ripple across your entire retirement—and estate—plan.

Here’s your mid-year Medicare prep checklist to stay ahead of the game:

Check what’s working—and what’s not. Have your health needs changed this year? Are your preferred doctors still in-network? Are you paying too much for prescriptions? Start keeping track.

Explore the “what-ifs.” Medicare alone doesn’t always cut it. Looking at supplemental or Advantage plans? Now’s the time to compare options—and weigh how your choices affect your financial future.

Plan for healthcare costs in your legacy. Out-of-pocket medical expenses can drain assets fast. Does your estate plan account for that risk? If not, it’s time for a tune-up.

Update your healthcare decision-makers. If your health situation or relationships have shifted, revisit your healthcare directive and HIPAA authorizations.

Connect the dots. Your insurance coverage, retirement income, and estate planning don’t exist in silos. The smartest plans are the ones where all three work together.

The bottom line? A little preparation now means no scrambling later—and more peace of mind for you and your loved ones.

If you’re unsure how your Medicare choices could affect your estate plan, we’re happy to talk it through.