Posts Tagged ‘Revocable Living Trusts’

What Property Can Be Placed in My Trust?

There are many benefits to creating a Revocable Living Trust as part of your estate plan, such as the ability to avoid probate and put a quick end to the estate administration process. However, creating a Revocable Living Trust will not automatically accomplish your goals and you may ask what property can be placed in…

Read MoreSkipping Probate in Orange County? Here’s What Will Happen

Probate in Orange County is a process in which a court decides whether a will is valid or not. It’s also legally required in most cases for the management and distribution of a decedent’s assets with or without a will. This definition suggests that if you are skipping probate, there’s no way to legally transfer…

Read MoreWhat Happens to a Mortgage After You Pass Away?

Estate plans usually concern who will get what, like money, jewelry, the house, and family heirlooms after a person dies. Little thought, though, is given to what will happen to debts when they die and what happens to a mortgage after you pass away? Many people expect to pay off their mortgage long before they…

Read MoreWhy You Need a Pour-Over With Your Living Trust

I get asked this question a lot: “If I have a trust, do I need a will?” The short answer is: “Yes, you do.” Of course, the next natural question is “why?” To understand the why, it’s helpful to first see the probate problem that can arise even when a Revocable Living Trust is in…

Read MoreSafe Places to Store Your Original Estate Planning Documents

Have you recently completed your estate plan with a will and trust lawyer? Congratulations! The hardest part is done. While you work to tie up any loose ends or “fund” your trust if necessary, now is also the time to give serious thought as to where you will store your original estate planning documents. Remember,…

Read MoreHow a Pour Over Will Works with a Living Trust

While most people have heard of a basic Last Will and Testament, they may not know what a Pour Over Will is and how it works with a Living Trust. As an Orange County will lawyer, I’d like to explain this estate planning tool. Essentially, a Pour-Over Will is used in conjunction with a Living…

Read MoreA Post-Honeymoon Legal Checklist for Orange County Newlyweds

Your wedding is over, and the day was absolutely perfect. You went away on your honeymoon with your new spouse and had the time of your lives. Now you are back and can breathe a sigh of relief and watch the rest of the years ahead unfold before your eyes. Well, not so fast. Now…

Read MoreHow to “Marie Kondo” Your Financial Life and Streamline Your Estate Planning Process

Listen to the Audio Version If you’re not familiar with Marie Kondo, take some time this week to watch one of her videos on YouTube or check out her new Netflix series, Tidying Up with Marie Kondo. It’s incredible to watch the relief and joy that people experience just by implementing her simple strategies to…

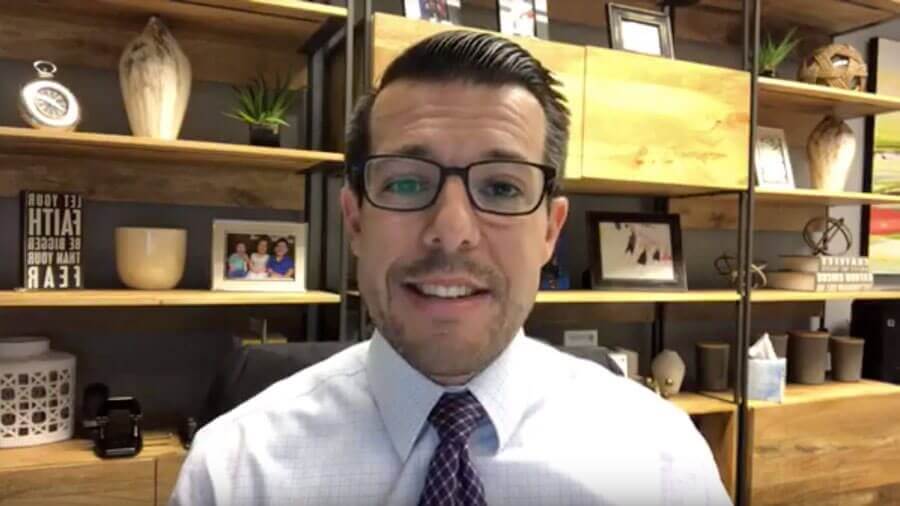

Read MoreHow Do I Talk to My Elderly Parents About Money Management?

While it may seem straightforward at first, there are a lot of details and difficulties that can get in the way of having the conversation with your aging or elderly parents. There are so many things to coordinate, and often the parent is less than helpful in the process. In this video, Kevin Snyder covers…

Read MoreApproaching the Conversation of Money Management With an Elderly Parent

Click to Listen to the Audio Version Estate Planning attorneys very often find themselves advising adult children of the elderly on the intricacies of managing their parents’ finances. While it may seem straightforward at first, there are a lot of details and difficulties that can get in the way. There are so many things to…

Read MoreEstate Planning in California is About More Than Planning for Death

Whether you live in Orange County or somewhere else in California, many of us believe that estate planning is simply instructions on how to distribute your assets when you pass away. From that perspective, estate planning is often viewed as something one does only after they have acquired substantial assets. While one major benefit of estate…

Read More