Posts Tagged ‘Living Trusts’

Approaching the Conversation of Money Management With an Elderly Parent

Click to Listen to the Audio Version Estate Planning attorneys very often find themselves advising adult children of the elderly on the intricacies of managing their parents’ finances. While it may seem straightforward at first, there are a lot of details and difficulties that can get in the way. There are so many things to…

Read MoreEstate Planning in California is About More Than Planning for Death

Whether you live in Orange County or somewhere else in California, many of us believe that estate planning is simply instructions on how to distribute your assets when you pass away. From that perspective, estate planning is often viewed as something one does only after they have acquired substantial assets. While one major benefit of estate…

Read MoreWhy You Should Sweat the Small Stuff in Your Estate Plan

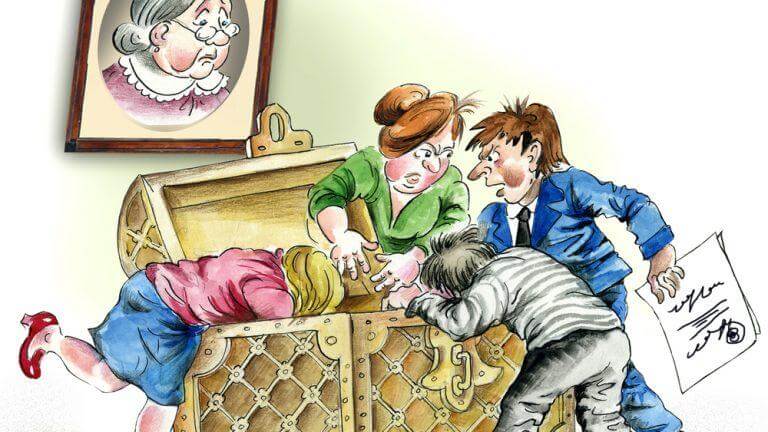

When planning their estates, most people focus on major assets, such as business interests, real estate, investments and retirement plans. But it’s also important to “sweat the small stuff” — tangible personal property. Examples include automobiles, jewelry, clothing, antiques, furniture, artwork, photographs, music collections, personal papers, collectibles (such as stamps, coins or baseball cards) and…

Read MoreSweat the Small Stuff in Your Estate Plan

When planning their estates, most people focus on major assets, such as business interests, real estate, investments and retirement plans. But it’s also important to “sweat the small stuff” — tangible personal property. Examples include automobiles, jewelry, clothing, antiques, furniture, artwork, photographs, music collections, personal papers, collectibles (such as stamps, coins or baseball cards) and…

Read MoreThree Legal Things to Do After a Scary Health Diagnosis

A scary health diagnosis can be emotionally and logistically challenging for many reasons. For instance, how can you take care of your family if you’re physically incapacitated? In addition to working closely with your medical providers, consider these three legal tips: Check your estate plan with your attorney to make sure it is up to…

Read MoreHow to Get Your Estate Planning Done in Just 10 Minutes

Research tells us that the majority of Americans today still do not have estate planning in place and only a third of parents have properly named legal guardians for their minor children. That’s problematic because life happens to all of us and gives none of us a heads up. But our message this week is not about…

Read MoreChecking Your Estate Plan: Is It a Trick or a Treat?

When was the last time you reviewed your estate plan? Do you know if it will work when you need it to and be a treat for your loved ones to manage? Or is there a nasty trick lying in wait? Get our Estate Plan Checklist to give your plan a quick audit. It’s no…

Read MoreThe Pitfalls of a Do-It-Yourself Estate Plan and How to Avoid Them

When the term “Do-It-Yourself” or “DIY” comes to mind, what do you think of? A weekend spent working hard on a home improvement project? An evening putting together your kid’s new bicycle? DIT projects can bring a lot of joy and pride from realizing you’ve accomplished something great on your own. On the other hand, doing…

Read MoreWhat You Need to Know About Your Safe Deposit Box Before It’s Too Late

Do you know how to access a safe deposit box after the death of a loved one? Never fear, you are not alone if you don’t know the answer. While safe deposit boxes are commonly used to protect valuable items and important documents (such as a insurance policies, a will, or a trust), it is…

Read MoreA Quick Guide to California Transfer on Death Deeds

You may have heard the buzz about the new transfer on death deeds in California which provide a new way to transfer real property on death. Up until recently, the most common ways were through: A will; Owning property in joint tenancy or community property with rights of survivorship; A revocable living trust. Some of these…

Read MoreDon’t Be April Fooled! Here’s 8 Ways to Protect Against Online Fraud

Are you afraid of your identity being stolen? Looking to protect against online fraud? You are not alone. Forbes reported a mobile security study in which 69% of respondents said that having others access their personal information is one of their biggest fears. However, the article also revealed that most Americans don’t take the proper precautions…

Read MoreSome Food for Thought When Reviewing Your Estate Plan

Estate planning is an ongoing process, and an estate plan review should be done every few years to ensure that your unique goals and needs are still being met. As I’ve mentioned before, your planning should never be merely a set of documents you execute once, stick on a shelf, and never look at again. …

Read More