In the realm of estate planning, much attention is often given to drafting wills, establishing trusts, and distributing assets. However, one crucial aspect that deserves equal consideration is the selection and empowerment of agents entrusted with carrying out your wishes when you are unable to do so yourself. These agents play pivotal roles in executing […]

Beneficiary

Maximizing the Benefits of Your Trust for a Secure Retirement

Preparing for retirement involves careful consideration of various financial tools and strategies to ensure a comfortable and secure future. Among these, a well-structured trust can play a pivotal role in safeguarding your assets, minimizing tax liabilities, and facilitating the seamless transfer of wealth to future generations. As you approach retirement, leveraging the benefits of your […]

Estate Planning for Veterans and Military Families

Estate planning is a critical undertaking for everyone, but for veterans and military families, it comes with unique challenges and opportunities. From government benefits to the complexities of military life, there are several factors to consider when crafting an estate plan that ensures financial security and peace of mind for your loved ones. Understanding Government […]

The Role of Trusts in Asset Protection and Growth

In the world of finance and wealth management, asset allocation is a crucial strategy for achieving long-term financial goals. One powerful tool in asset protection and growth is the use of trusts. Trusts provide a flexible and efficient means to manage assets, protect them from various risks, and optimize investments, especially during market fluctuations. The […]

The Whys and Hows of Talking to Your Kids About Your Estate Plan

Talking about the taboo topics of money and death in one conversation is not most people’s idea of a good time. Many may say that talk of death makes them uncomfortable, and to discuss money would simply be impolite. Yet, when it comes to your family and their future, these connotations should be set aside […]

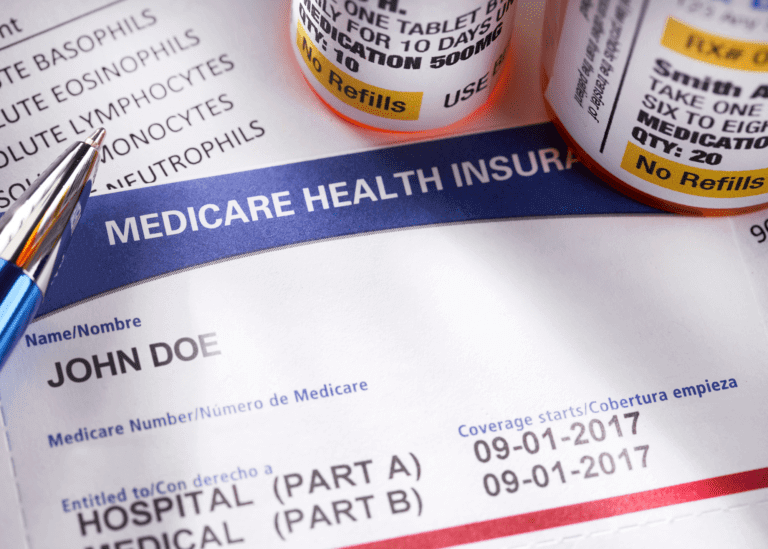

Navigating the Medicare Annual Enrollment Period

The Medicare Annual Enrollment Period (AEP) is a critical time for Medicare beneficiaries to review and make changes to their healthcare coverage. Whether you’re new to Medicare or have been enrolled for years, understanding the AEP and knowing how to prepare can help you make the best choices for your healthcare needs. What Is the […]

Protect Your Family’s Future

Life, with its unpredictability and surprises, underscores the importance of preparedness. While we revel in its beautiful moments, it’s also essential to brace ourselves for its uncertainties. For many, the primary motivation behind estate planning is the genuine desire to safeguard their family’s future, especially in the face of unexpected events. By creating a comprehensive […]

The ABCs of Estate Planning

As the back-to-school season rolls around, parents everywhere are busy with preparations – from buying new school supplies to setting up schedules and routines. But amidst the rush of a new academic year, there’s another essential matter that parents should prioritize: estate planning. Just as you prepare your children for a successful school year, it’s […]

Extra Layer of Protection to Your Trust

Trusts have long been recognized as powerful tools for managing and protecting assets, ensuring their seamless transfer across generations. They provide a robust framework that allows individuals to safeguard their wealth and exercise control over its distribution. While trusts offer numerous benefits, some individuals may desire an additional layer of protection and oversight. Enter the […]

Navigating Affairs After a Loved One’s Passing

The loss of a loved one is a challenging and emotional time. Amidst the grieving process, there are practical matters that need attention, especially in relation to your loved one’s estate. Estate planning plays a vital role in ensuring a smooth transition and proper distribution of assets. Here are 10 important steps to take when […]

Is Signing Away an Inheritance the Best Option?

Inheritance is often viewed as a significant windfall that can bring financial security and stability to one’s life. However, there are situations where individuals may choose to sign away their inheritance willingly. This decision, although unconventional, can carry various benefits depending on personal circumstances and considerations. What does Signing Away an Inheritance Mean? Signing away […]

How to Plan for Your Child to Turn 18

Planning for your child’s transition into adulthood is an important step in ensuring their success and independence. Here are some tips for planning for your young adult to turn 18: 1. Talk About Finances As your child turns 18, they will become legally responsible for their own finances. This means it’s important to talk to […]

How to Plan For A Child With Special Needs

Estate planning is an important consideration for all parents, but it is especially important for parents of special needs children. It is important for parents of special needs children to have a solid estate plan in place to ensure that their child’s needs are met and their assets are managed appropriately. Here are 4 considerations […]

“Should I leave $1 in my will or trust to disinherit an heir?”

If I had a dollar for every time someone asked this question when creating an estate plan… well, you get the point. There’s a common belief that if you want to disinherit an heir, say an adult child, that you should leave them $1 and nothing more in your will or trust. The thought is […]

What Happens to a Mortgage After You Pass Away?

Estate plans usually concern who will get what, like money, jewelry, the house, and family heirlooms after a person dies. Little thought, though, is given to what will happen to debts when they die and what happens to a mortgage after you pass away? Many people expect to pay off their mortgage long before they […]

Estate Planning Tips for Single Parents

As a single parent, it is critically important to have a comprehensive estate plan that protects your child(ren). Obviously, being the sole or primary caregiver doesn’t leave you with much time on your hands. However, putting some time aside to meet with an estate planning attorney can give you some peace of mind. By having […]

How to Claim Death Benefits After the Loss of a Loved One

Dealing with outstanding financial affairs after the loss of a loved one can be extremely difficult. Our probate attorneys often hear from clients who would rather do anything else than think about money after their loved one’s passing. Unfortunately, death comes with expenses, and even a modest funeral and burial can cost many thousands of […]

Should You Leave a Life Insurance Policy Outright to a Spouse?

Wondering if you should leave a life insurance policy outright to a spouse? Naming a legal beneficiary is necessary for life insurance, annuities, qualified retirement plans, individual retirement accounts, and some bank accounts. Ideally, these assets will be paid directly to whoever you have selected as your beneficiary in the event you passed away. The […]

Irvine Will and Trust Lawyer: 5 Essentials of Estate Planning

Estate planning isn’t just for older people, couples with children, or individuals with a lot of financial wealth. Single people, young adults, and those with a modest income can also benefit from estate planning. As an Irvine will and trust lawyer, I believe there are five essential items that should be considered by every adult, […]

6 Mistakes to Avoid When Creating a Special Needs Trust

A Special Needs Trust (also called a Supplemental Needs Trust) is a legal document that holds assets for a person with disabilities, while also providing legal authority for a trustee to manage money and make financial decisions on behalf of the individual with special needs. Read on to discover four common mistakes in creating a […]